Safe and Affordable Financing for

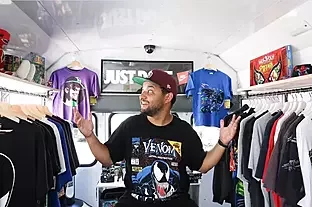

Minority-Owned Businesses

$20,000 to $5,00,000

LEEF provides non-predatory business loans through its partnerships with over 30 lenders, private funds, (CDFI)’s, banks, credit unions, and non-profits. LEEF is minority-owned and we have experience working with entrepreneurs from the African-American, Latino, women, LGBTQIA+, immigrant, veteran, and other communities that have been historically excluded from traditional financing. We adhere to the Small Business Borrowers’ Bill of Rights and we provide free business advising and loan application assistance. We look forward to helping you grow your business.

Committed to Minority-Business Owners

LEEF was founded in 2002 as an informal group of volunteers from Abyssinian Baptist Church. In 2025, LEEF became a mission-driven for-profit entity to continue our work helping diverse entrepreneurs achieve business success. We support businesses from all walks of life; whether you are a startup needing capital to launch your or an established business ready to expand. We are here to help you succeed and have a positive impact on our community.

Non-Predatory Financing Between 7% and 12.5%

Why Our Process is Different

We do things differently. We’re here to support you and provide you with business loan options that are safe, affordable at the right rate and terms that will help you grow your business

You are more than just a credit score.

94%

Base on loan size

Approval Rate

We work with you through the application process.

Customized Loan Sizes

Flexible Term Lengths

Affordable Rates

Deal Real People Here to Help

Amazon Black Business Accelerator

LEEF has helped minority-owned businesses obtain the resources to participate in Amazon's Black Business Accelerator for sellers. It provides thousands of entrepreneurs with education, financial support, and mentorship opportunities that have help them connect with more customers and build their brands.

We are proud to support these organizationsand the work they do for minority-owned businesses.